Demystifying Private Equity - Part 1: Why Private Equity May Be the Smartest Move for Your Portfolio's Next Chapter

- Matt Schwegman

- Jun 25, 2025

- 3 min read

Updated: Jul 28, 2025

This is the first of our three-part series on Private Equity. This article focuses on the WHY. Part 2 explores the various strategies employed by private equity firms. Our final piece in the series will get into HOW you can invest in the private asset class.

If you’re nearing retirement or already retired and live in Austin, San Antonio, Houston, or Dallas, you may be entering a new phase of wealth management—where growth, preservation, and portfolio sophistication all matter.

But here’s the problem: traditional small-cap stocks are no longer delivering.

Small Cap Performance is Falling Behind

Over the last 15 years, U.S. small-cap equities have consistently underperformed their large-cap counterparts.

Source: MSCI USA Large and Small Cap Indices

Why? These high-growth companies didn't just disappear. It's because many of the best small companies are being bought by private equity firms—before they ever have a chance to grow in the public markets.

That means fewer high-quality opportunities for individual investors in the small-cap space.

Source: JP Morgan

Private Equity Growth Potential

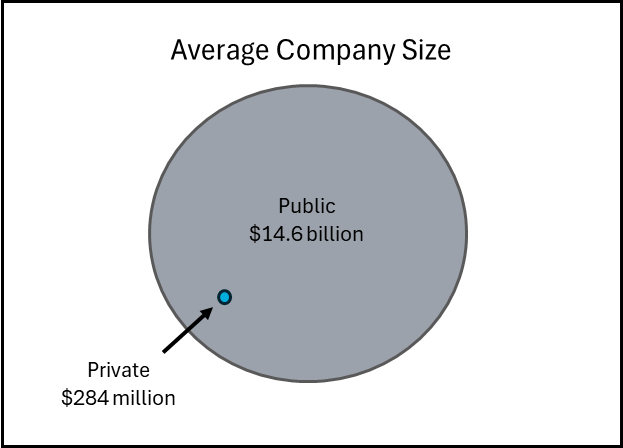

Here’s the US public vs private landscape:

Public Market Cap: $58.4 trillion

Private Market Cap: $3.1 trillion

Average Public Company Size: $14.6B

Average Private Company Size: $284M

Source: S&P Global, JP Morgan

Private markets are smaller overall, but they’re where growth and innovation are happening—especially in sectors such as tech, healthcare, and energy.

What This Means for High-Net-Worth Investors

If you're planning for retirement, optimizing your tax picture, or thinking about a business exit, it's time to consider a shift in portfolio strategy.

Private equity offers:

✅ Exposure to high-growth companies

✅ Diversification away from volatile public markets

✅ Potential for stronger long-term returns

The Results: Private Equity Wins vs Public Small Caps

A $100,000 investment in private equity starting at the beginning 2015 would have turned into $363,801 by the end of 2024. This is a gain of $263,801, equating to a 13.8% annual return. On the other hand, public small-cap equity returned only 8.4% over the same 10-year time period. The end result is that an investment in private equity would have made you $139,736 more than an investment in public small caps.

Source: SPDR Portfolio S&P 600 Small Cap ETF, Cambridge Associates LLC US Private Equity Index®

Public Small Cap Equity | Private Equity | |

Starting Value | $100,000 | $100,000 |

Ending Value | $224,065 | $363,801 |

Gain | $124,065 | $263,801 |

10-Year Total Return | 224.1% | 363.8% |

Annual Return | 8.4% | 13.8% |

And it is not just about returns. Adding private equity to a portfolio also reduces volatility. The visual below, created by JP Morgan Asset Management, shows that adding 5% to 15% of private equity to a portfolio not only increases returns but also decreases volatility.

Source: Burgiss, Factset, JPMorgan Asset Management¹.

How We Help

At ComposedPro Wealth, we have reviewed hundreds of private equity offerings and narrowed down the list to 5 that we believe present the best opportunities for our clients. The five opportunities pursue different strategies and have varying investment minimums and qualifications for investment. In Part of our series on Private Equity, we will discuss the various strategies that Private funds pursue.

To invest in one of these five private equity funds, you need to be either an Accredited Investor, Qualified Client, or Qualified Purchaser. We will delve further into these qualifications, as well as the specifics of how you can invest in Part 3 of our Private Equity Series, "How to Invest in Private Equity."

Let’s Talk About Elevating Your Portfolio

Whether you're a tech entrepreneur in Austin, a physician in San Antonio, an executive in Dallas, or in Houston’s energy sector—we're here to help you take the next step in your financial life.

🗓 Schedule a private consultation to explore how private equity could fit into your wealth strategy.

📞 Call us directly at 210-910-4432 or📩 Click here to book your appointment

¹ Past performance is not a reliable indicator of current and future results. Stocks are represented by the S&P 500 Total Return Index while bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Portfolios rebalanced at the start of the year. Private equity performance is pooled industry performance from Burgiss. The performance is net of fees and expenses charged by underlying managers and is gross of fees and expenses charge by the advisor.

Comments